What is COBRA?

COBRA, an acronym for the Consolidated Omnibus Budget Reconciliation Act, is a federal law in the United States that enables qualified employees and their dependents to maintain their group health insurance coverage for a limited duration following a significant life event, such as job loss or a reduction in working hours. Under COBRA, individuals have the option to retain their former health insurance plan while footing the entire premium cost, which includes the portion previously covered by their employer, often making it more expensive. The coverage period under COBRA typically spans 18 to 36 months, contingent upon the specific circumstances surrounding the qualifying event.

While COBRA can serve as a viable choice in cases of job loss or transitions, it is not without its drawbacks. The disadvantages associated with COBRA include:

- High cost: Subscribers are responsible for the full premium, which can be considerably pricier.

- Temporary: It offers coverage for a limited 18-36 month period, lacking long-term insurance security.

- Administrative complexities: Dealing with various insurers may result in confusion.

- Lack of subsidies: COBRA does not receive employer support, rendering it costly for individuals.

- Limited flexibility: COBRA requires individuals to maintain the same coverage they had previously.

- Strict enrollment deadlines: There is a 60-day limit to elect COBRA.

- Potential coverage gaps: Transitioning to COBRA may result in brief periods without insurance.

Introducing Start Health

Rather than relying on COBRA when your employer-sponsored coverage ends, consider the versatile, network-free, and affordable health insurance coverage offered by Start Health. Start Health is an innovative health insurance alternative based on a reimbursement model that is not tied to any specific employer, providing a high degree of flexibility in contrast to COBRA.

How Does it Operate?

Start Health members receive predetermined reimbursement rates for covered medical procedures. They have the freedom to seek care from any healthcare provider, without being restricted by networks, and receive reimbursement accordingly. This flexibility allows members not only to have their medical procedures covered but also to potentially earn money when they choose providers whose costs are lower than Start Health’s fixed reimbursable rates. For instance, if the fixed reimbursement rate for a procedure is $900, and a member opts for a provider offering the same procedure for $700, they can earn $200.

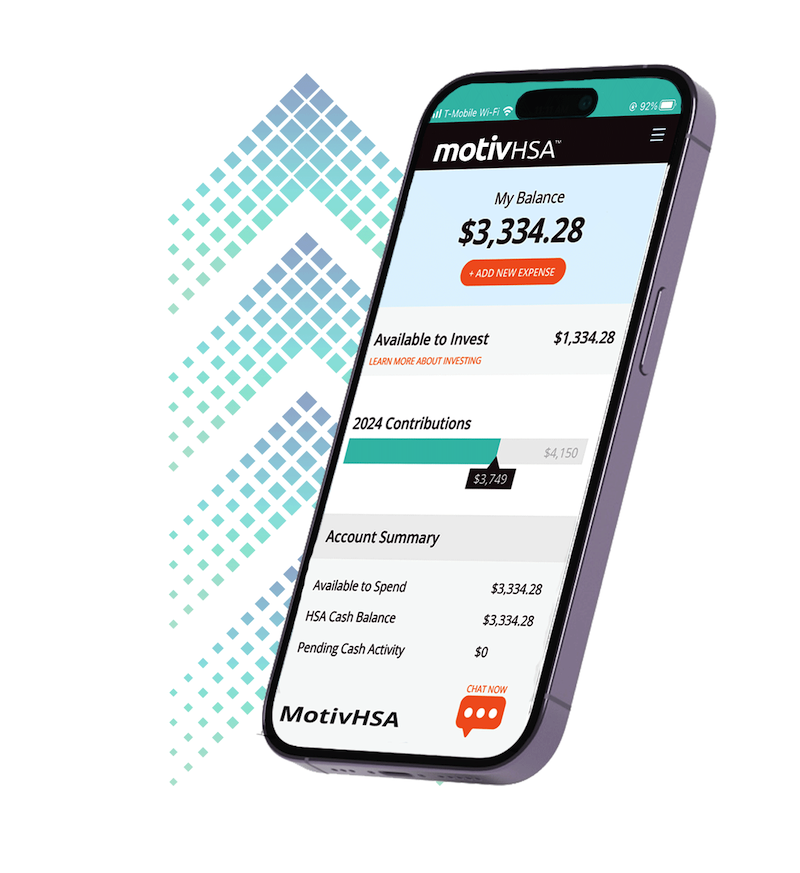

In addition to Start Health’s innovative reimbursement approach, it is the only health insurance alternative that is compatible with Health Savings Accounts (HSAs). Health Savings Accounts provide a unique triple-tax advantage, featuring tax-free contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. These accounts are entirely owned by the individual and can be transferred from one employer to another. They are also effective as retirement savings, as the funds roll over annually and can be utilized for non-medical expenses after reaching the age of 65, with those expenses subject to regular taxation.

For a personalized insurance quote, visit starthealth.com/quote today.

No Comment