By MotivHealth

The Birth of Health Insurance

A little over a century ago, healthcare had practically no regulations at all, and health insurance did not exist. This is because before the 1920s there was very little that physicians could do to treat illnesses, and healthcare treatment almost always took place in the patient’s own home. It wasn’t even until 1910 that the first disease-killing drug (that didn’t also kill the patient) was invented. Between 1910 and 1920, surgery became more successful and more common, creating a need for sterile environments in which surgery could be performed: hospitals. The popularization of hospitals, as well as other medical advancements, created higher healthcare costs. By 1929, five percent of the average family’s income was spent on healthcare. Overwhelmed by this financial burden, a group of Dallas school teachers contracted with Baylor University Hospital to receive 21 days of healthcare for monthly payments of just fifty cents. And thus, health insurance was born.

The Rise of Health Insurance

Health insurance continued to rise in popularity due to the Great Depression. It then became normalized because of its mutualistic relationship with both health consumers and health providers—health consumers generally paid less for healthcare while health providers received a consistent stream of income. The Baylor University plan inspired the creation of 26 health insurance groups with a total of 600,000 members. Eventually, these groups all combined into the Blue Cross network, which was officiated by the American Hospital Association. Employers started offering health insurance as an employment benefit during World War II when they could not afford to raise wages and had to find an alternate way to attract new hires. By this point, health insurance had become mainstream, and by the 1960s it was considered a right.

Health Insurance All Grown Up

Towards the end of the 20th century, health insurance’s childhood bliss came to an end. Health insurers began to seemingly care less about their customers and more about saving money. Health insurance agencies also began to deny coverage on procedures and instituted unreasonably priced premiums. There were no regulations to stop insurers from behaving what could be considered unethically. The debate on health insurance ethics is still unresolved, and the government continually disputes the level of regulation that should occur within private health insurance institutions. The Affordable Care Act of 2010 attempted to offer a partial solution by expanding both private and public health insurance to cover approximately 32 million uninsured Americans. Nonetheless, health insurance ethics still have room to improve, and health insurance has largely lost the trust of its consumers.

MotivHealth’s Solution

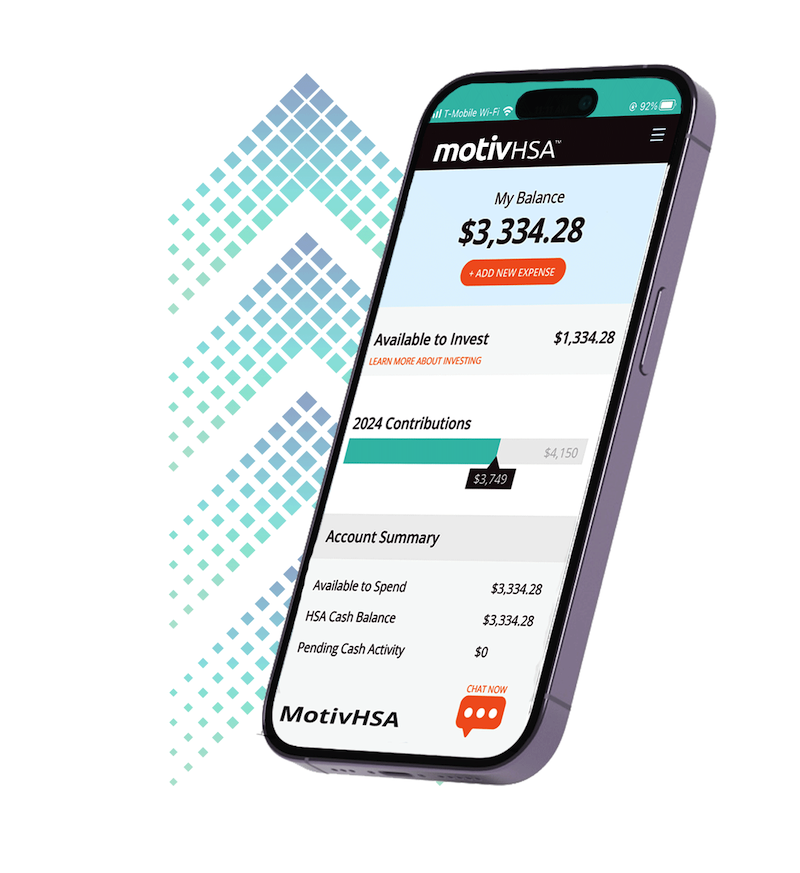

MotivHealth aims to rebuild the trust consumers once had in health insurance. Like other health insurers, MotivHealth does care about saving money. However, by saving themselves money MotivHealth saves their members money in the process, and they save them big. Its model is mutually beneficial, and that’s why it is the solution. For example, MotivHealth’s SmartPay program combats the rising costs of healthcare by saving members an average of $250 – $5,000 per procedure (often more). Likewise, its MotivRx program helps members lower or often eliminate out-of-pocket medication costs. These are just a few of the programs and resources available to MotivHealth members.

Sources:

“Ethics for a Better Society An Example: Health Insurance”

Sircon.com

“The Affordable Care Act: A Brief Summary – March 2011”

NCSL

“The U.S. Health Care Non-System, 1908-2008”

George B. Moseley III

No Comment