Tips and Tricks

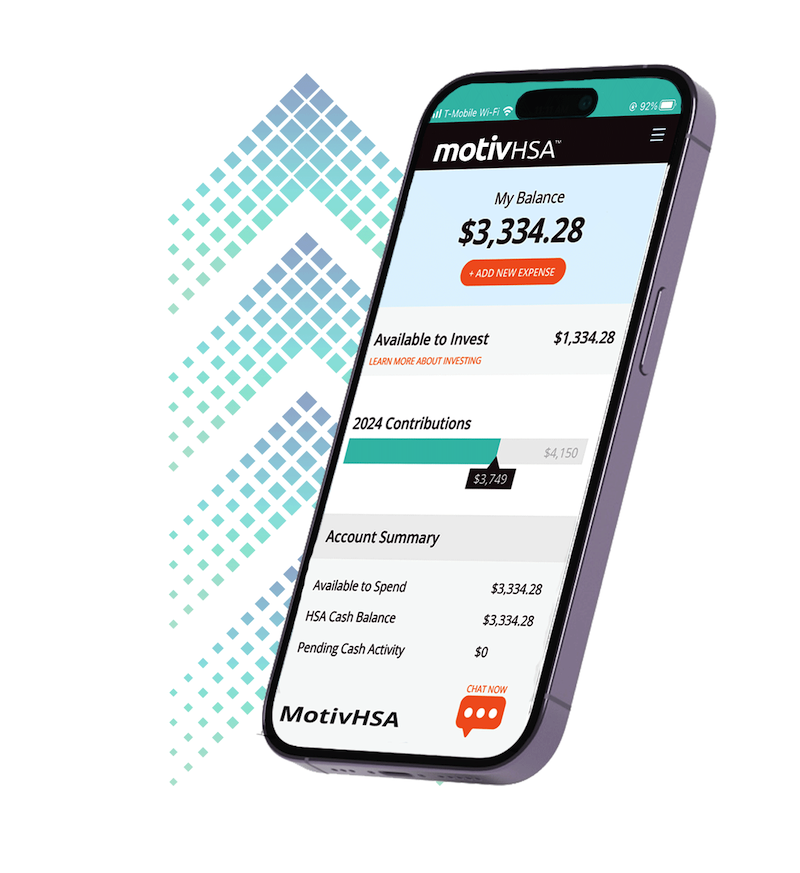

Top 10 HSA Platforms

The 10 Best HSA Platforms in the USA Health Savings Accounts (HSAs) are a powerful tool for managing healthcare expenses while enjoying tax advantages. Selecting the right HSA platform can significantly impact how effectively you save and invest your healthcare dollars. Below is a list of the top 10 HSA platforms in the USA. 1. …

5 Foods That Ruin Your Workout

Pre-workout foods that will dampen your intensity and affect your results By Greg Marshall, The GYM at City Creek 1. Fast Food Fast foods are not a good pre-workout meal because they have a lot of empty calories and fat content. These meals also have a lot of sugar-based carbohydrates, which spikes your insulin and …

Reducing the Risk of Outliving Your Money

What steps might help you sustain and grow your retirement savings? Provided by Mark K. Lund “What is your greatest retirement fear?” If you ask retirees that question, “outliving my money” may likely be one of the top answers. Retirees and pre-retirees alike share this anxiety. In a 2014 Wells Fargo/Gallup survey of more than …

Securing Health Insurance Between Jobs

Transitioning between jobs might leave you uncertain about health insurance coverage, but fortunately there are several coverage options for individuals.

Farewell, COBRA

What is COBRA? COBRA, an acronym for the Consolidated Omnibus Budget Reconciliation Act, is a federal law in the United States that enables qualified employees and their dependents to maintain their group health insurance coverage for a limited duration following a significant life event, such as job loss or a reduction in working hours. Under …

High or Low Deductible?

Which is better, a high or a low deductible? That’s how most people see and select health insurance. But what if we asked if you prefer a LOW premium or a HIGH premium, then which would you pick?

Harnessing the Power of HSA Funds for a Comfortable Retirement

Retirement planning can seem like a daunting task, especially for millennials who are juggling student loans, housing costs, and other financial responsibilities. However, there’s a valuable tool that many millennials may not be fully aware of: Health Savings Accounts (HSAs).

Navigating Health Insurance Costs for Business Owners

For business owners in the United States earning over $70,000 annually, the Affordable Care Act (ACA) has brought about substantial changes in the realm of health insurance. While the ACA aimed to improve access to healthcare, its impact on small and medium-sized business owners has been a topic of debate. In this article, we’ll explore …

The Gift of Health Savings

By MotivHealth HSAs: The Gift of Health Savings 2022 has been a year of massive inflation and economic uncertainty. Yet amidst all this, national HSA contributions increased compared to last year. Not only that, but 48% of millennials and Gen Z’ers are now using HSAs to invest for retirement. The popularity of HSAs is only increasing in the face …

Kitchen Tricks to Make You Feel Like A Culinary Master

Turn soft shell tortillas into hard shell tacos by draping them over the lines of an oven rack, spraying with oil and baking for ten minutes at 375. For toasted sandwiches, try putting two pieces of bread into the same toaster slot. The inside remains soft and the outside gets toasted, just like you …