by Start Health

QUESTION – Which is better, a high or a low deductible?

That’s how most people see and select health insurance. But what if we asked if you prefer a LOW premium or a HIGH premium, then which would you pick?

You should know that it’s not a simple either-or scenario. A LOW deductible generally accompanies a HIGH monthly premium. And a HIGH deductible generally offsets a LOW monthly premium. So, now which would you prefer? Health insurance with a HIGH deductible and a LOW premium, or the opposite—a plan with a LOW deductible and a HIGH premium?

The answer is like many things…. It depends.

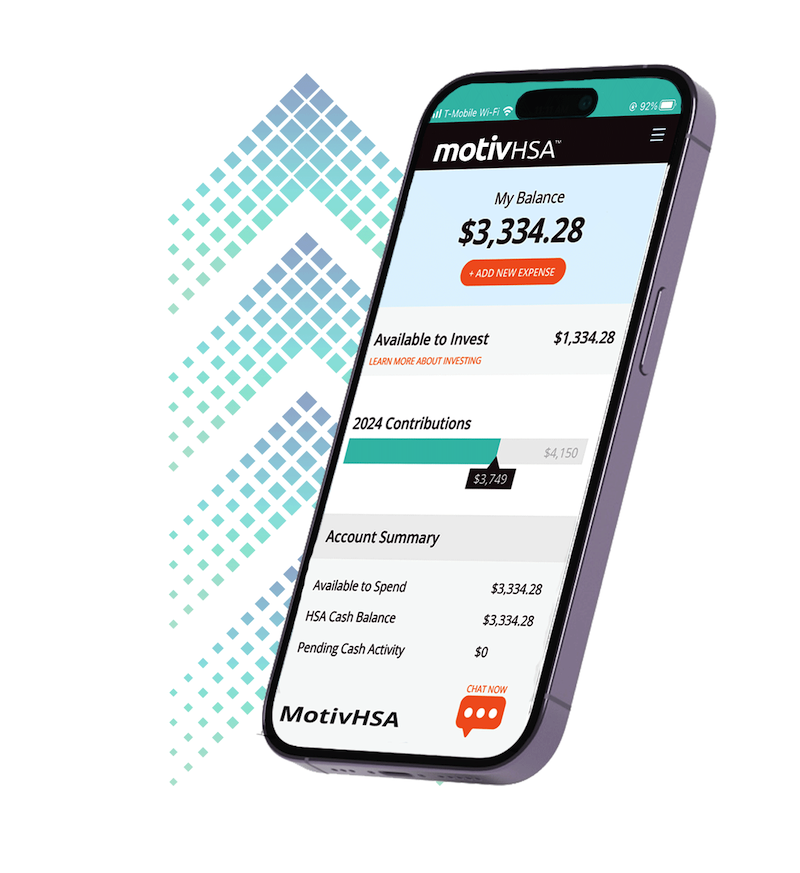

If you know you’ll need to use the medical system frequently, you will probably opt for a higher premium and lower deductible. BUT… if you are healthy, why would you want to spend MORE of your own money on a premium for “What-If” medical costs that you might not use? On the other hand, you could spend on a LOWER premium and save more money in the bank or in an HSA for future medical costs. If you do need medical care, sure—you’ll be paying a higher deductible for actual care—but you saved money on your premium. If you parked that away in savings, you’re actually better off. Do you want to pay for care you MAY need, or pay for care you ACTUALLY need? If you’re healthy, the best option is to have a highd-deductible, HSA-qualified health plan with a low premium. You can then contribute the savings from your lower premium into a triple-tax- advantaged HSA for the days when you do need healthcare. It pays to be smart. It pays to use Start.

No Comment