By MotivHealth

Health savings accounts (HSAs) are somewhat new to the healthcare industry, only having made their debut in 2003. However, the concept of HSAs started coming together in the 1980s when Congress began discussing medical savings accounts (MSAs). Medical savings accounts were originally intended to allow healthcare consumers to set aside tax-free money specifically for medical expenses and then spend these savings tax free. (Sound familiar?) MSAs finally took the stage in 1996 with The Health Insurance Portability and Accountability Act. Over a five-year period, MSAs were tested on employees of small firms (with 50 employees or less) and self-employed individuals.

The Fall of MSAs

The MSA experiment wasn’t all smooth sailing. HIPAA laws restricted MSAs from becoming available to all American consumers. MSA deposits were also subject to income and payroll taxes, and unspent funds could not be rolled over to accumulate and earn tax-free interest. On February 28, 2001, George W. Bush proposed that MSAs become permanent and that certain HIPAA restrictions be lifted. The Bush administration suggested that MSAs be made available to anyone with a high deductible health plan. As existing MSA laws were set to expire in 2003, the government weighed various health savings options. (Ultimately, only 150,000 MSAs were opened before HSAs became the preferred health savings method.)

Weighing the Options

The Whitehouse wanted to create health savings accounts that were available to all U.S. taxpayers and could pay for any medical expenses. It was hoped that such a savings tool could even serve as a retirement vehicle. It all sounded great, but Congress was shaken by such an account’s implications on the U.S. budget. Another step towards the birth of HSAs was taken with a new ruling on health reimbursement arrangements (HRAs). (HRAs are health plans set up by employers for their employees. Employers can decide how much they want to contribute to the plan, and employees can request reimbursement for medical expenses up to the determined amount. Unlike HSAs, they are not accounts. Employees cannot contribute to HRAs nor withdraw funds.) In June 2002, the U.S. Treasury Department issued a ruling clarifying that HRA funds could be rolled over from year to year, tax– free. It was a step in the right direction, but HRAs could never be cashed out and rarely stayed in place amidst a job change.

Present-Day HSAs

Finally, as an amendment to The Medicare Prescription Drug, Improvement, and Modernization Act, HSAs were officially signed into law on December 8, 2003, and became available to U.S. taxpayers with high deductible health plans on January 1, 2004, and have evolved into an unmatched savings tool. Unlike MSAs, they provide a triple-tax advantage: tax-free contributions, tax-free growth, and tax-free spending. And, unlike HRAs, they are an account and employees can contribute and withdraw funds from them. Combining HSAs with high deductible health savings plans is arguably the best way to keep healthcare costs down. High deductibles mean lower premiums, and tax-free HSA funds can be used to pay off deductible amounts.

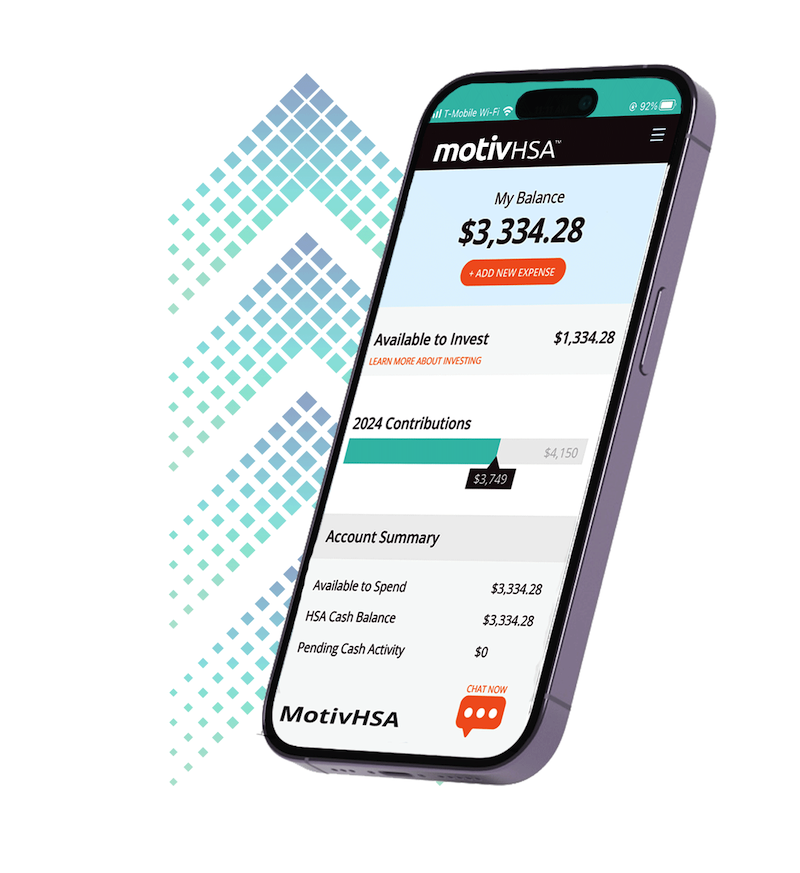

Through MotivHealth’s member portal, members can check their HSA balance at any time and even take advantage of in-house investing. Call them 24/7/365 at (844) 234-4472 with any questions or learn more at motivhealth.com/hsa.

Sources

“A Brief History of Health Savings Accounts”

Devon Herrick

“Fact Sheet: Guidance Released on Health Savings Accounts (HSAs)”

United States Office of the Press Secretary

“Health Reimbursement Arrangement (HRA)”

Investopedia

“Health Savings Accounts”

U.S. Department of the Treasury

“History of Health Savings Accounts – MSAs to HSAs”

PeopleKeep

“H.R.1 – Medicare Prescription Drug, Improvement, and Modernization Act of 2003”

Congress.gov

“Medical Savings Accounts Progress Problems Under HIPAA”

Cato.org

No Comment