By MotivHealth

Rising Premiums Nationwide

Between 2009 and 2019, health insurance premiums increased faster than inflation, and in the aftermath of COVID-19, premium increases are expected to get even worse. Healthcare spending per person is projected to grow from $11,600 in 2019 to $17,000 by 2027. These numbers seem frightening, but MotivHealth Insurance Company has the solution: high deductible health savings plans. In an economy with ever-increasing healthcare costs, high deductible health plans are essential because they drastically lower your premiums. MotivHealth’s average increase in annual premium is less than two percent for our clients.And, if you combine your high deductible plan with a health savings account (HSA) you’ll gain even more control over your healthcare dollars.

High Deductibles are Better than High Premiums

“High” is not an appealing descriptor when it comes to healthcare fees, but since you will always be paying either a high deductible or a high premium, you should know that high deductibles typically leave you with more cash in your wallet. Think of it this way: Would you want to pay a monthly subscription to a gym that you never work out in? Sure, it’s nice to have the gym available as an option in case you muster the motivation to exercise, but if you only work out once in a blue moon, why pay a monthly fee for it? Health insurance plans are similar. If you rarely get sick or injured, why pay a high “just-in-case” fee every single month? Pay only what you need, and keep the rest.

HSAs are an Exceptional Tool

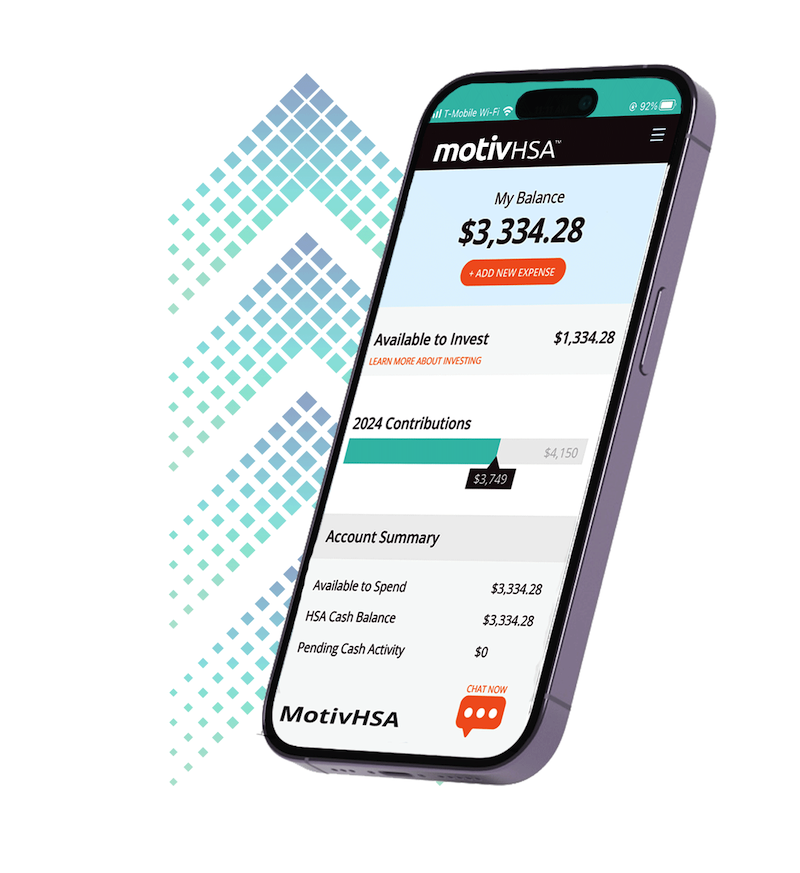

Many people are intimidated by the amount that high deductibles require them to pay out of pocket in the event of an injury or illness. That is where HSAs come in. HSAs allow you to save up healthcare dollars tax-free and even invest those dollars. In fact, HSAs have a triple tax advantage: money is deposited pre-tax, grows tax-free, and can be spent tax-free. HSA savings roll over from year to year, stay in place amidst a career change, and often receive employer contributions. These tax-free safety nets serve as your “just-in-case” money, rather than a high monthly premium—and unlike premiums, this “just-in-case” money is yours to keep if you don’t use it, not the insurance company’s.

The aftermath of COVID-19 has brought about a great deal of economic uncertainty. It is a time of growth and adjustment. Switching from a traditional health insurance plan to a high deductible health savings plan may be one of the most beneficial adjustments you can make. If you want to know how to maximize your HSA savings, or simply save on healthcare, call MotivHealth’s PHAs anytime 24/7 at (844) 234-4472 or visit motivhealth.com.

Sources

“Health Insurance Premiums are Rising. Are You Prepared?”

Renée Sazci

“How Has U.S. Spending on Healthcare Changed Over Time?”

Rabah Kamal et al.

No Comment