The 10 Best HSA Platforms in the USA

Health Savings Accounts (HSAs) are a powerful tool for managing healthcare expenses while enjoying tax advantages. Selecting the right HSA platform can significantly impact how effectively you save and invest your healthcare dollars. Below is a list of the top 10 HSA platforms in the USA.

HealthEquity stands as one of the leading HSA providers, offering a user-friendly platform with robust features. With 24/7 customer support and seamless integration with various health plans, it caters to both individuals and employers. The platform provides a range of investment options, allowing users to grow their savings tax-free.

- Key Features:

- 24/7 customer service

- Diverse investment options

- Easy integration with health plans

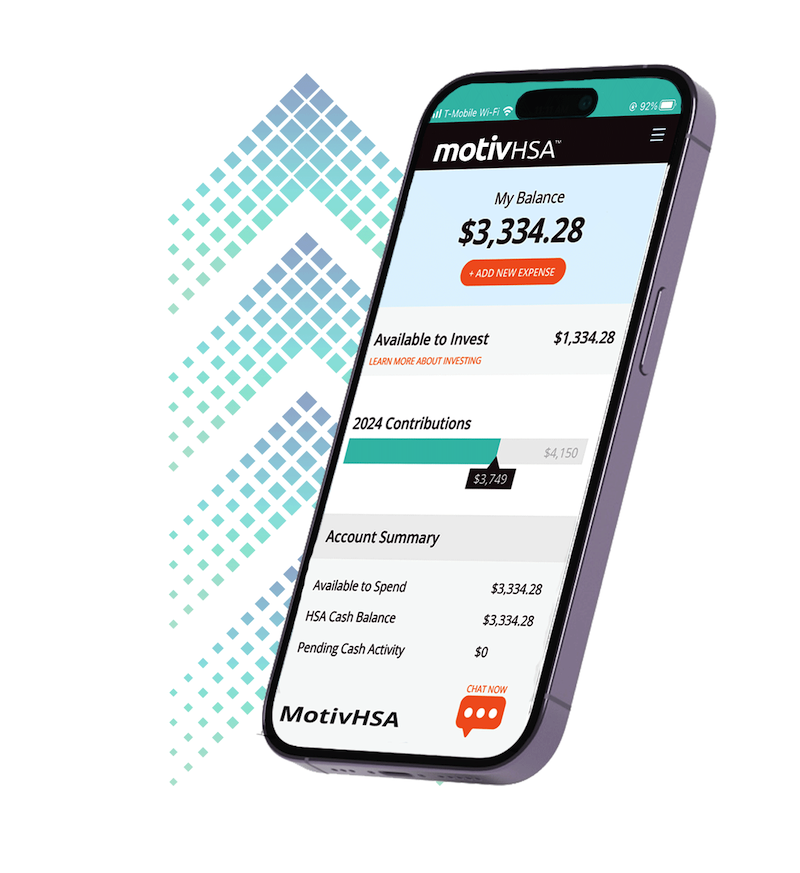

From seasoned investors to beginners, MotivHSA’s intuitive interface empowers members to make informed decisions, manage their investment portfolio, and stay ahead of market trends. MotivHSA unlocks the capability of your healthcare savings with its robust investment platform. MotivHSA members on average yield a return of 14 percent.

- Key Features:

- In-house investment platform

- Zero fees on accounts with balance over $2,000

- Personalized customer service (speak with real people)

Fidelity offers an HSA with no account fees and a wealth of investment options, including mutual funds and ETFs. The platform integrates seamlessly with other Fidelity accounts, providing a unified financial management experience.

- Key Features:

- No account fees

- Wide range of investment options

- Integrated financial services

Lively is known for its modern, intuitive platform and zero fees for individuals. It offers various investment choices through partnerships with TD Ameritrade, making it an excellent option for those looking to maximize their HSA growth.

- Key Features:

- No fees for individuals

- User-friendly interface

- Strong investment options

Optum Bank provides comprehensive HSA services with a focus on easy account management and customer support. The platform offers investment options and tools to help users make informed healthcare spending decisions.

- Key Features:

- Comprehensive online tools

- Investment options

- Strong customer support

Bank of America’s HSA platform allows users to manage their health savings alongside their banking needs. With a variety of investment options and educational resources, it’s a solid choice for those who prefer integrated financial services.

- Key Features:

- Integrated banking and HSA services

- Educational resources

- Investment opportunities

Powered by Old National Bank, The HSA Authority offers HSAs with competitive interest rates and personalized customer service. It provides a straightforward platform suitable for both individuals and employers.

- Key Features:

- Competitive interest rates

- Personalized service

- Employer-friendly options

With over two decades of experience, HSA Bank offers flexible options for spending and investing HSA funds. The platform provides a variety of mutual funds and self-directed investment choices.

- Key Features:

- Flexible spending options

- Self-directed investments

- Long-standing industry presence

Saturna Capital specializes in investment options for HSAs, including socially responsible funds. It’s ideal for savvy investors who want to align their healthcare savings with their financial goals and values.

- Key Features:

- Socially responsible investment options

- Expert investment management

- Educational investment resources

Formerly known as SelectAccount, Further provides tools and resources to manage healthcare expenses effectively. The platform offers investment options and is known for excellent customer service.

- Key Features:

- Comprehensive management tools

- Investment opportunities

- Strong customer support

No Comment